A inventory technique is a vital tool for anybody aiming to achieve the economic markets. It offers a transparent, systematic approach to building financial commitment decisions. By leveraging sector insights, economic details, and chance assessments, investors can produce a roadmap that aligns with their financial ambitions. With the right approach, you can also make informed alternatives, reduce hazards, and optimize returns.

Having a very clear inventory system provides several Added benefits. It minimizes psychological choice-producing, which regularly causes losses. A solid strategy assures you keep focused on your aims and boosts your possibilities of acquiring better returns. Additionally, a properly-investigated approach will give you a further comprehension of market place dynamics, enabling you to anticipate trends and make timely moves.

To establish a successful inventory approach, start off by defining your fiscal targets. Contemplate regardless of whether you're saving for extensive-expression reasons like retirement or aiming for short-expression gains. Realizing your goals should help form your expense conclusions. Up coming, evaluate your possibility tolerance. Conservative investors may well lean toward bonds or secure stocks, when danger-tolerant persons may well take a look at large-advancement options.

Investigate is really a important component of any stock tactic. Analyze market place traits, company functionality, and economical statements to determine prospective investments. Instruments like SWOT Assessment will help you assess the strengths, weaknesses, chances, and threats of the inventory. Also, diversification is essential to balancing risks and rewards. Spread your investments across various sectors to mitigate the effect of a inadequate-doing stock.

Remaining knowledgeable about industry developments is important. Routinely observe money information and updates from reliable platforms. Subscribe to industry reviews and forecasts to stay in advance of variations that would have an impact on your investments.

Many stock methods can do the job very well for newbies. Value investing involves acquiring New Stock Strategy undervalued stocks with substantial advancement likely. This method normally calls for patience, given that the rewards may perhaps arrive over the long term. Advancement investing, Then again, focuses on corporations with constant profits growth, featuring the potential of superior returns. Dividend investing is another well known choice, as it provides frequent earnings along with capital appreciation. For anyone seeking simplicity, index investing by ETFs or index resources offers a Value-helpful and reduced-threat Resolution.

Avoiding prevalent problems is very important for expense good results. Never ever skip exploration before you make a call. Chasing sector traits without the need of understanding them can lead to losses, as can overtrading, which increases transaction fees and reduces returns. Always foundation your selections on knowledge, not emotion.

In conclusion, a nicely-structured stock system is the muse of profitable investing. It helps you navigate the complexities of the market though cutting down challenges and maximizing probable gains. By starting off with distinct aims, thorough investigate, plus a diversified portfolio, you can generate a strategy that grows and evolves with all your economic aspirations. Get started now and make a secure money long term.

Neve Campbell Then & Now!

Neve Campbell Then & Now! Romeo Miller Then & Now!

Romeo Miller Then & Now! Danica McKellar Then & Now!

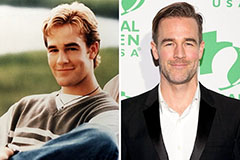

Danica McKellar Then & Now! James Van Der Beek Then & Now!

James Van Der Beek Then & Now! Morgan Fairchild Then & Now!

Morgan Fairchild Then & Now!